Page 18 - Steel Tech India eMagazine Volume April 2022

P. 18

VOL. 16 • NO. 3 • April 2022

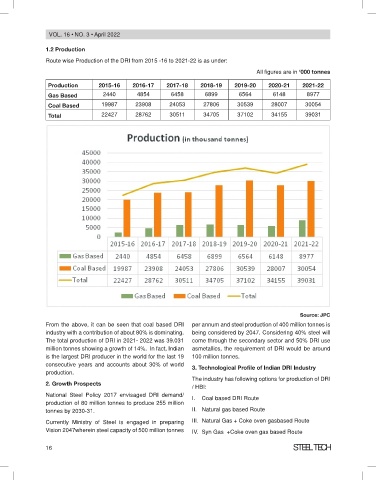

1.2 Production

Route wise Production of the DRI from 2015 -16 to 2021-22 is as under:

All figures are in ‘000 tonnes

Production 2015-16 2016-17 2017-18 2018-19 2019-20 2020-21 2021-22

Gas Based 2440 4854 6458 6899 6564 6148 8977

Coal Based 19987 23908 24053 27806 30539 28007 30054

Total 22427 28762 30511 34705 37102 34155 39031

Source: JPC

From the above, it can be seen that coal based DRI per annum and steel production of 400 million tonnes is

industry with a contribution of about 80% is dominating. being considered by 2047. considering 40% steel will

the total production of DRI in 2021- 2022 was 39.031 come through the secondary sector and 50% DRI use

million tonnes showing a growth of 14%. In fact, Indian asmetallics, the requirement of DRI would be around

is the largest DRI producer in the world for the last 19 100 million tonnes.

consecutive years and accounts about 30% of world 3. Technological Profile of Indian DRI Industry

production.

the industry has following options for production of DRI

2. Growth Prospects

/ hBI:

National Steel Policy 2017 envisaged DRI demand/ I. coal based DRI Route

production of 80 million tonnes to produce 255 million

tonnes by 2030-31. II. Natural gas based Route

currently Ministry of Steel is engaged in preparing III. Natural Gas + Coke oven gasbased Route

Vision 2047wherein steel capacity of 500 million tonnes IV. Syn Gas +coke oven gas based Route

16 Steel tech